How Small Spaces Forged a Big Global Business Opportunity

A Qantas Points business secret has helped media company Never Too Small unlock travel and cash flow, paving the way for it to take its passion for small-footprint living to the world.

Filmmaker Colin Chee grew frustrated when looking for inspirational and innovative ways to design his 37-square-metre apartment in Melbourne’s CBD.

“It’s not much bigger than two regular-sized car spots,” says Chee. “I used to spend hours on YouTube looking for cool ways people had designed small spaces but it was either filled with architectural jargon I couldn’t understand or wasn’t focused on the design.”

Wanting to learn more about small-space design, Chee decided to use his filmmaking skills gleaned on the job at production company New Mac to document beautiful yet tiny homes created by renowned Australian architects such as Nicholas Gurney and Brad Swartz.

In the process, Chee wanted to shine a light on the unique world of small footprint living while picking up some creative tips for himself. And so Never Too Small, a media company dedicated to small-footprint design and living, was born.

When Chee posted that first video back in 2017, he could never have imagined that five years later the Never Too Small YouTube channel would have amassed a global subscriber base of more than 2.2 million people, and achieve 170 million views in the process. The viral success of the videos has seen Never Too Small grow into a renowned voice in architecture, showcasing designers around the world.

“We have a network of eight full-timers and 12 freelancers located around the world that work to achieve the content we put out there,” says Chee. “Back in the day we were sitting at hundreds of views and now we can regularly expect three million views a month across our videos. This provides revenue through sponsorships and served ads.”

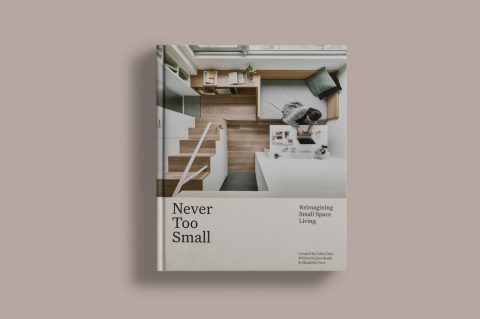

While YouTube is central to Never Too Small’s success, the publisher has looked beyond the internet to grow. A short series with Screen Australia, Small Footprint, and a successful book, Never Too Small: Reimagining Small Space Living – distributed globally – are both focused on the company’s core message of tackling urban overcrowding issues worldwide, while improving quality of life.

“The book is something I'm quite proud of,” says Chee. “It’s been on the Amazon bestsellers list for architecture and design books for quite some time. We didn’t think it’d be so well received.”

Publishing the book and launching its own ecommerce platform was part of Never Too Small’s strategy to diversify the business’ income streams away from YouTube advertising and video monetisation. The business needed to scale quickly and with flexibility – which drew them to the American Express® Qantas Business Rewards Card. With no pre-set spending limit, businesses can access a dynamic line of unsecured funding.¹

“The Card has been really important to us in the establishment of our ecommerce business. We can only make revenue when selling our book directly to our customer. And so we needed international warehouses to use as distribution bases for our book, which was expensive to establish. And we needed it quickly. Now we have one in Chicago and one that’s opening in Amsterdam soon. We didn’t realise we would suddenly be competing with Amazon.”

Having extra cash flow days² with the American Express Qantas Business Rewards Card – especially when managing a variety of different costs and revenue streams at the same time.

“We put a variety of billings, like warehouse rent, book delivery through third-party providers and digital marketing on our American Express Qantas Business Rewards Card. Having up to 51 days to pay for purchases² on the Card is a luxury that means we can continue to scale the business without running into cash issues,” says Never Too Small co-founder, James McPherson.

Maximise your cash flow

The ability to earn up to 1.25 Qantas Points per $1 spent on everyday expenses³, plus the 2 Qantas Points per $1 on Qantas products and services³, added to the appeal of the Card.

“For a business that’s intrinsically linked with international cities, global travel is inevitably part of our business model so it just makes sense,” says McPherson.

“As the world opens up again, Colin is doing more international speaking gigs. He was in Austria recently and is heading to Thailand again shortly. It gives us the option to take advantage of the Qantas Points the business earns with the Card to book flights and upgrade our content creators to Business for trips around the world,” adds McPherson.

“It has also come in handy for booking flights for our next television series, Wonderful Waste, which I’ve been shooting in Europe,” says Chee. “It’s going to be focused on 60 innovative designers and producers and how they reuse old materials to create new building materials.”

Amex Qantas Business Rewards

Best of all, the Qantas Points don’t expire as long as the business earns or uses points at least once every 18 months. It gives the Never Too Small team the flexibility to use their points where and when they need them.

The Card’s complimentary travel insurance⁴ is just another feature that Never Too Small makes good use of.

“The built-in travel insurance is really competitive, and when we’re travelling it’s good to know you have the coverage there. We used it on that same European shoot,” says McPherson.

For Chee, his goal is not only to expand the Never Too Small business but build on the original message of small-space living, which calls on people to rethink how they use their homes, the cities they live in and how “smaller” living leaves a smaller footprint.

“What I want for Never Too Small is for that message to grow, and now with the new series, for it to focus on building materials, on sustainable furniture and other aspects of home design.”

Unlock the possibilities for your business. Earn 130,000 bonus Qantas Points* when you apply by 14 January 2025, are approved and spend $3,000 on eligible purchases on your new American Express Qantas Business Rewards Card within 2 months of your approval date. T&Cs apply. Available for new American Express Card Members only. Annual fee of $450 applies. Learn more.

Unlock the possibilities

Colin Chee and James McPherson share their top business tips…

• The key to… travelling affordably

“As a global publisher, we’re a business that is connected to travel, featuring small spaces and architects around the world,” says McPherson. “Earning up to 1.25 Qantas Points for every $1 spent on everyday business expenses³ and having those points not go to waste is great for us when we want to get to an international shoot or treat one of our freelancers to an upgrade to Business.”

• The key to… finding an audience

“Right now there are about 4.4 billion people that live in cities and if you look at the studies, by 2050 every seven of 10 of us will be living in cities,” says Chee. “So I think we tapped into something that is global and now we are trying to grow it through the various media tapestries. For example, getting the TV series distributed in China and the book translated to grow the audience.”

• The key to… minimising travel risk

“We used the travel insurance that is complimentary on the Card⁴ for a recent shoot, after doing some comparison against other insurance offerings, for Colin when he was in Europe shooting our upcoming series, Wonderful Waste,” says McPherson. “It’s good that you can use the points for travelling and know you also have that protection behind you when you book return trips with the card.”

• The key to… diversifying revenue streams

“When we decided that Never Too Small could be a business in its own right, we knew we had to look beyond YouTube and the advertising revenue generated to make something of it,” says McPherson. “Scaling a business is a balancing act but with no pre-set spending limit¹ on our American Express Qantas Business Rewards Card, it’s made it easy for us to get our message to audiences across new mediums like the book and produce the television series.”

• The key to... measuring success

“We don’t really like words like ‘viral’ but YouTube has always been our main data source for success. Views and average view duration are the most important metric for us,” says Chee. “But it’s not everything, we also like to look at the success of the small-footprint living book and acquiring more funding from Screen Australia to do our second show as alternative measures of our success."

Unlock the possibilities for your business. Earn 130,000 bonus Qantas Points* when you apply by 14 January 2025, are approved and spend $3,000 on eligible purchases on your new American Express Qantas Business Rewards Card within 2 months of your approval date. T&Cs apply. Available for new American Express Card Members only. Annual fee of $450 applies. Learn more.

Click here for Terms and Conditions

SEE ALSO: How Two School Friends Created a Global Activewear Empire

*130,000 bonus Qantas Points: Offer only available to new American Express Card Members who apply by 14 January 2025, are approved and spend $3,000 on eligible purchases on their new Card in the first two (2) months from the Card approval date. Eligible purchases do not include Card fees and charges, for example annual fees, interest, late payment, cash advances, balance transfers, traveller’s cheques and foreign currency conversion. Card Members who currently hold or who have previously held any Card product issued by American Express Australia Limited in the past 18 months are ineligible for this offer. 130,000 bonus Qantas Points will be awarded to the eligible Card Member's Account 8-10 weeks after the spend criteria has been met. Subject to the American Express® Qantas Business Rewards Card Points Terms and Conditions. $450 annual fee applies. This advertised offer is not applicable or valid in conjunction with any other advertised or promotional offer.

American Express approval criteria applies. Subject to Terms and Conditions. Fees and charges apply. All information is correct as at 1 January 2023 and is subject to change. This offer is only available to those who reside in Australia. Cards are offered, issued and administered by American Express Australia Limited (ABN 92 108 952 085). ®Registered Trademark of American Express Company.